Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Or, if using Excel, the break-even point can be calculated using the “Goal Seek” function. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License .

Break-even Calculator

This break-even calculator allows you to perform a task crucial to any entrepreneurial endeavor. Please go ahead and use the calculator, we hope it’s fairly straightforward. If you’d rather calculate it manually, below we have described how to calculate the break-even point, and even explained what is the break-even point formula. Break-even analysis assumes that the fixed and variable costs remain constant over time. However, costs may change due to factors such as inflation, changes in technology, and changes in market conditions. It also assumes that there is a linear relationship between costs and production.

Break-even point Formula and analysis

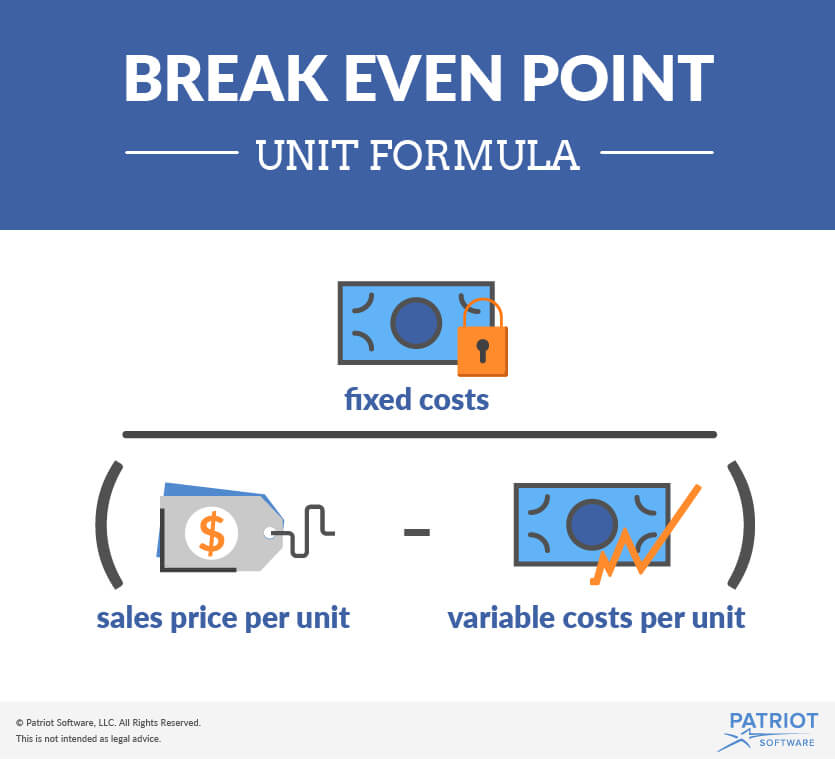

For example, we know that Hicks had $18,000 in fixed costs and a contribution margin ratio of 80% for the Blue Jay model. We will use this ratio (Figure 3.9) to calculate the break-even point in dollars. The break-even point is your total fixed costs divided by the difference between the unit price and variable costs per unit. Keep in mind that fixed costs are the overall costs, and the sales price and variable costs are just per unit. Borland Manufacturing achieves its break-even point at $6,250,000 in total revenue.

- Your contribution margin shows you how much take-home profit you make from a sale.

- Use your break-even point to determine how much you need to sell to cover costs or make a profit.

- Let’s assume that we want to calculate the target volume in units and revenue that Hicks must sell to generate an after-tax return of \(\$24,000\), assuming the same fixed costs of \(\$18,000\).

- While the breakeven point is a valuable tool for decision-making, it has several limitations.

- The break-even point is the point at which there is no profit or loss.

Assumes constant selling prices

Launching a new product or service can be exciting but equally intimidating, especially when you’re unsure how much you’ll need to sell to cover your costs. It helps you figure out how many units you need to sell or services you need to provide to make sure your investment pays off. For instance, if your restaurant is introducing a new signature dish, you’ll want to know how many orders of that dish you need to sell to cover the costs of ingredients, staff time, and marketing. Break-even analysis looks at internal costs and revenues, but doesn’t factor in external influences that can impact your business. — e.g., changes in market demand, economic conditions, inflation, supply chain disruptions, etc. For instance, if shipping costs rise due to global supply chain problems, your variable costs might go up and can throw off your original calculation.

This analysis can also serve as a much needed advisor on cutting costs and fixing selling prices. However, it might be too complicated to do the calculation, so you can spare yourself some time and effort by using this Break-even Calculator. All you need to do is provide information about your fixed costs, and your cost and revenue per unit. To make the analysis even more precise, you can input how many units you expect to sell per month. A person starting a new business often asks, “At what level of sales will my company make a profit? ” Established companies that have suffered through some rough years might have a similar question.

Expense Behavior

Break-even analysis ignores external factors such as competition, market demand, and changes in consumer preferences. Now, as noted just above, to calculate the BEP in dollars, divide total fixed costs by the contribution margin ratio. What happens when Hicks has a busy month and sells 300 Blue Jay birdbaths? We have already established that the contribution margin from 225 units will put them at break-even. In this method, your goal is to determine the level of output that produces a net income equal to zero. This method requires unit information, including the unit selling price and unit variable cost.

Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Knowing the break-even interest rate is important 5 payment reminder templates to ask for overdue payments in comparing bonds. With it, you can make your own predictions about what the future will bring and make a decision accordingly.

Therefore, ABC Ltd has to manufacture and sell 100,000 widgets in order to cover its total expense, which consists of both fixed and variable costs. At this level of sales, ABC Ltd will not make any profit but will just break even. The formula for break-even point (BEP) is very simple and calculation for the same is done by dividing the total fixed costs of production by the contribution margin per unit of product manufactured. First we take the desired dollar amount of profit and divide it by the contribution margin per unit.

If the revenues come from a secondary activity, they are considered to be nonoperating revenues. For example, interest earned by a manufacturer on its investments is a nonoperating revenue. Interest earned by a bank is considered to be part of operating revenues. In conclusion, just like the output for the goal seek approach in Excel, the implied units needed to be sold for the company to break even come out to 5k. The incremental revenue beyond the break-even point (BEP) contributes toward the accumulation of more profits for the company.

The breakeven formula for a business provides a dollar figure that is needed to break even. This can be converted into units by calculating the contribution margin (unit sale price less variable costs). Dividing the fixed costs by the contribution margin will reveal how many units are needed to break even. In the annual report to shareholders, Borland Manufacturing reported total gross sales of $7,200,000, total variable costs of $4,320,000, and total fixed costs of $2,500,000.

Break-even analysis can help determine those answers before you make any big decisions. For example, if the demand for your product is smaller than the number of units you’ll need to sell to breakeven, it may not be worth bringing the product to market at all. Finding your break-even point gives you a better idea of which risks are really worth taking. Insurance Expense, Wages Expense, Advertising Expense, Interest Expense are expenses matched with the period of time in the heading of the income statement. Under the accrual basis of accounting, the matching is NOT based on the date that the expenses are paid.