It’s important to note that different intangible assets have different methods of calculating their amortization expenses. Some assets might use straight-line depreciation while others use accelerated or unit-of-production methods. This is a question that often arises when discussing financial statements and accounting practices. Amortization expense represents the systematic allocation of an intangible asset’s cost over its useful life. It allows businesses to recognize the expense over time, rather than all at once.

What can be amortized?

The amortization expense will go straight to the income statement. Amortization is an accounting process used to allocate the cost of an intangible asset over its useful life. It is an important tool for businesses as it helps to spread out the cost of an intangible asset, allowing for more accurate financial reporting. They will guide you on which accounts to use and which journal entry records the amortization of an expense how to calculate and allocate expenses correctly based on your unique circumstances. In accounting, amortization is the allocation of the cost of the intangible asset over the periods that the company receives the benefits from the asset. Likewise, the company needs to make the journal entry for the amortization expense in each period that it allocates the cost.

What are the five main adjusting entries?

To record an unearned revenue, an accountant would debit a liability account and credit a revenue account. Adjustment entries are an essential aspect of accounting that helps ensure the accuracy and completeness of financial statements. These entries are made at the end of an accounting period to correct errors, omissions, and discrepancies in financial transactions. The balance sheet is a financial statement that displays your business’s assets, liabilities, and equity.

- It holds numerous patents and copyrights for its inventions and innovations.

- The assets will be useless at the end of the useful life, so the company has to record it to expense.

- Sometimes, amortization also refers to the reduction in the value of a loan.

- To reflect this decrease in value, firms amortize their patents.

- However, there is a key difference in amortization vs. depreciation.

- It expires every year and can be renewed annually without a renewal limit.

What is Amortization Expense?

On the income statement, typically within the “depreciation and amortization” line item, will be the amount of an amortization expense write-off. ABC Co.’s expenses in its Income Statement will increase by $2,000. At the same time, its Balance Sheet will report an intangible asset of $8,000 ($10,000 – $2,000). The interest expense here results in an increase in a company’s overall expenses in the Income Statement.

Is amortization a liability or expense?

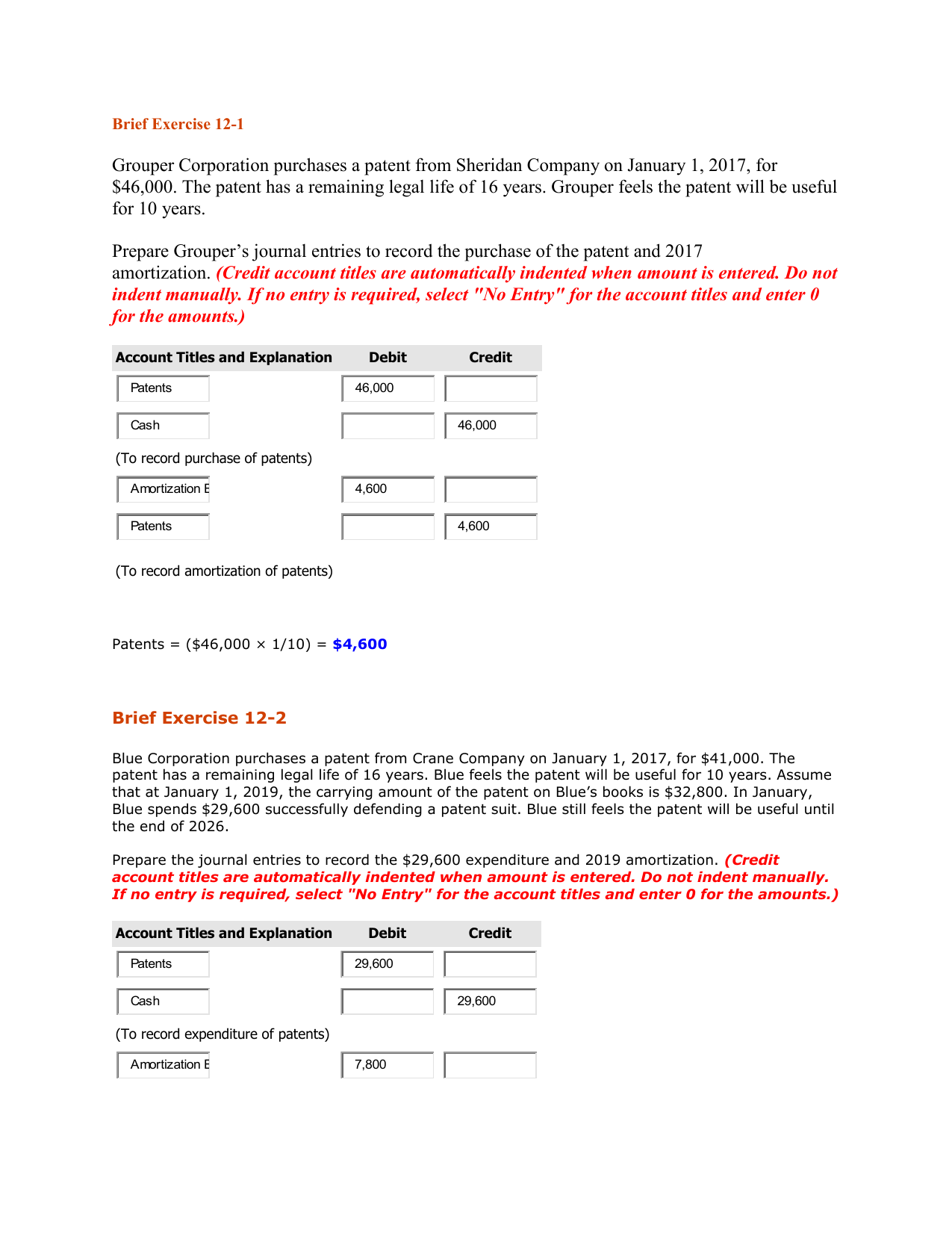

A company spends $50,000 to purchase a software license, which will be amortized over a five-year period. The annual journal entry is a debit of $10,000 to the amortization expense account and a credit of $10,000 to the accumulated amortization account. The company has to calculate the amortization expense based on the intangible assets value and its define useful life.

The journal entry for amortization differs based on whether companies are considering an intangible asset or a loan. Amortization, in accounting, refers to the technique used by companies to lower the carrying value of either an intangible asset. Amortization is similar to depreciation as companies use it to decrease their book value or spread it out over a period of time. Amortization, therefore, helps companies comply with the matching principle in accounting. This entry reduces the value of the intangible asset on the balance sheet by 2,000 and recognizes the expense on the profit & loss account. You would repeat this entry each year until the asset is fully amortized.

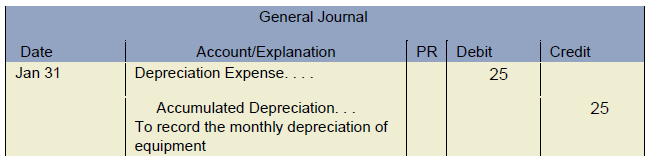

To record amortization, an accountant would debit an expense account and credit an accumulated amortization account. It means the balance of the assets will decrease in order to increase the expense. However, it is a bit complicated as we will not credit assets balance directly. We create another account which is the accumulated amortization to be the contra account of the intangible assets. When this account balance increases, it will decrease the assets’ net book value on balance sheet.

For example, different kinds of patents have various lifespans. A design patent has a 14-year lifespan from the date it is granted. This linear method allocates the total cost amount as the same each year until the asset’s useful life is exhausted. It is the concept of incrementally charging the cost (i.e., the expenditure required to acquire the asset) of an asset to expense over the asset’s useful life. By now, you should be able to predict what the journal entry for amortization will look like.